cryptocurrency tax calculator us

This means you can get your books. Subscription plans start with 99year for Starter to 1899year for the Accountant plan.

How To Calculate Crypto Taxes Koinly

Our customers choose us over other.

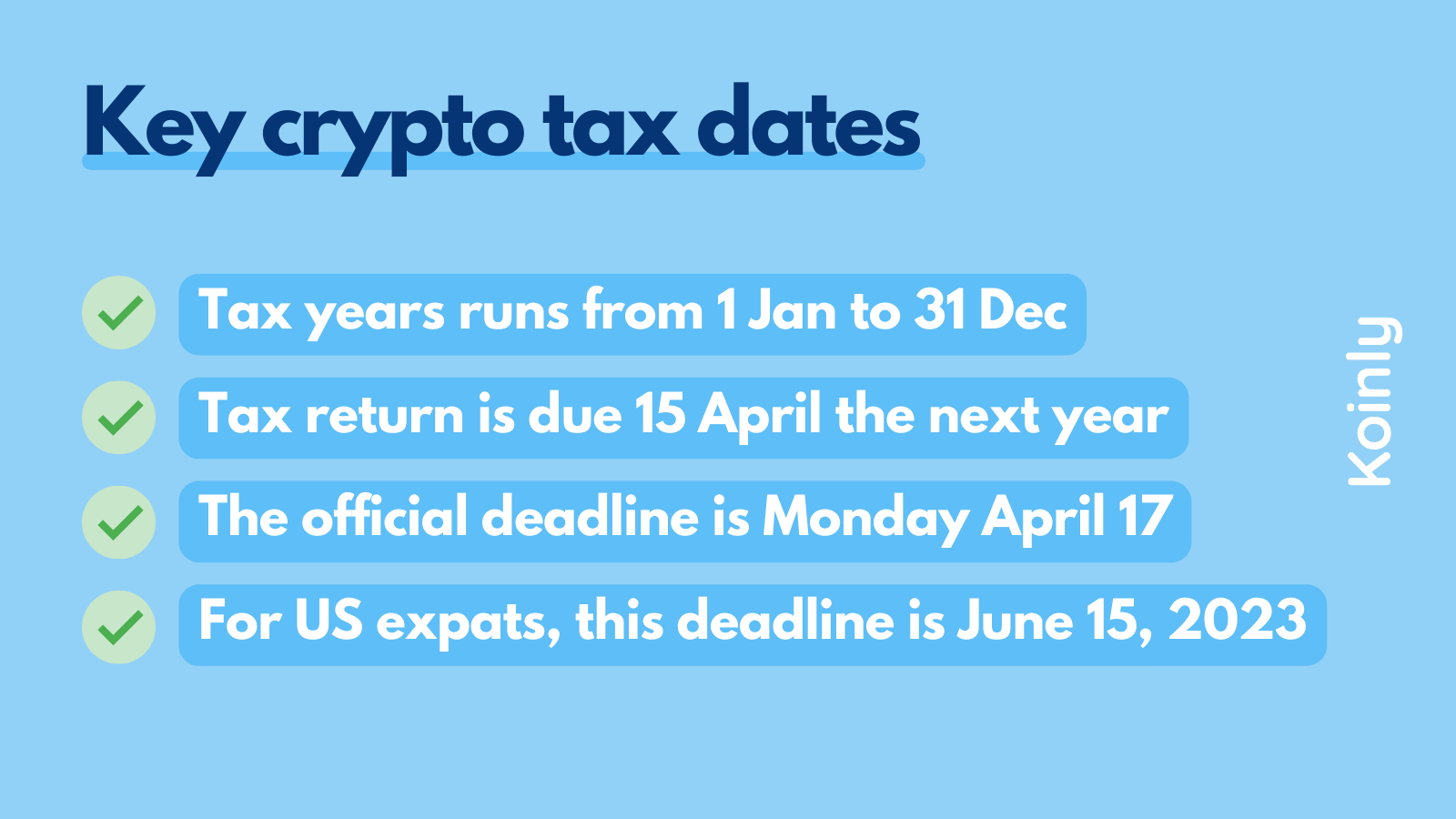

. Select your tax filing status. If you owned it for more then a year youll pay the long-term rate which is lower. The popularity of cryptocurrencyBitcoin investments continues to skyrocket.

Crypto Tax Calculator Use our calculator to get an estimate of the taxes on your cryptocurrencybitcoin sales. Use code BFCM25 for 25 off on your purchase. If you held it for a year or less youll pay the short-term rate.

You can estimate what your tax. Select the tax year you would like to calculate your estimated taxes. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while.

They allow users to cancel a subscription at any time with a 30-day money-back. Forbes recently posted this handy guide with a chart of the 2020-2021 tax brackets for your reference. The new software as a service SaaS application simplifies the process of US tax filings for those who hold cryptocurrency assets and need to report so on their US tax returns.

Choose your tax filing status. You simply import all your transaction history and export your report. Enter your taxable income minus any profit from crypto sales.

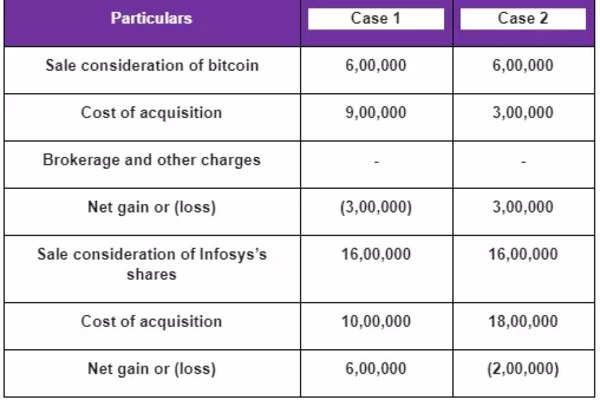

Lets calculate the tax in the above example. Free Crypto Tax Calculator for 2021 2022. This guide details the tax obligations for crypto investors and answers many commonly asked questions on a wide range of scenarios that may apply to your crypto.

According to CIRA tax treaties and information exchanges exist between Canada and other nationsAdditionally The Canada Revenue Agencys CRA policy is to treat. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Enter Your Personal Details.

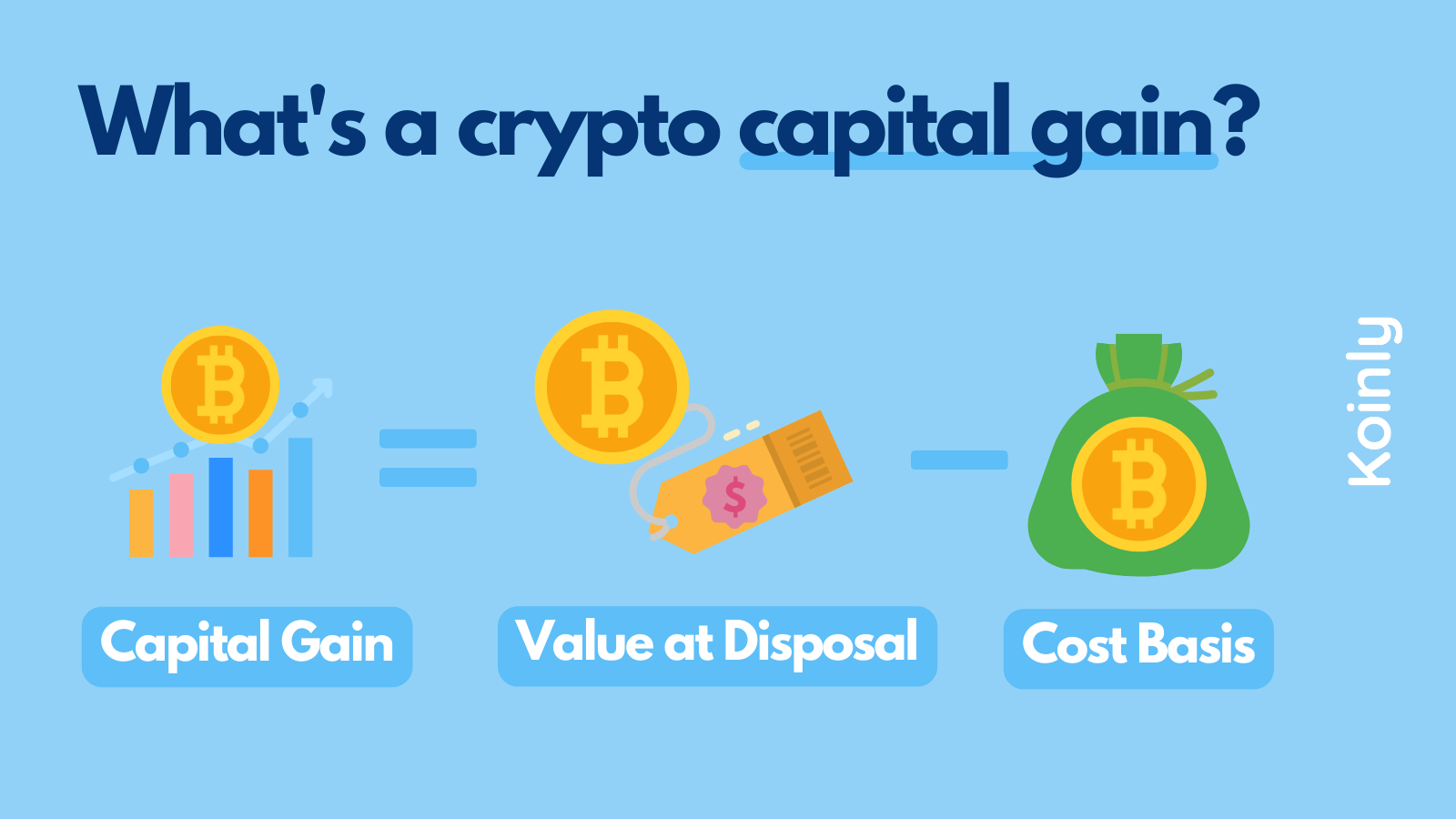

A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions. Valid from 1126 to. Cost price April 3000.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Select the appropriate tax year. In this article we go over the main features of a cryptocurrency tax calculator.

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give. If your annual income is less than 9875 youll be subject to a 10 tax rate on your. LIFO Last-In-First-Out According to the LIFO accounting.

Enter your taxable income. According to a May 2021 poll 51. 2021 Filing Status Estimated 2021 Taxable Income Cost of.

US Tax Guide 2022. A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions.

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

The Ultimate Crypto Tax Guide 2022 Coinledger

Coinpanda Free Bitcoin Crypto Tax Software

Explained How Budget 2022 Announcements Affect Your Earnings From Crypto Investments Times Of India

Free Crypto Tax Calculator Coinledger

The Ultimate Crypto Tax Guide 2022 Coinledger

Crypto Tax Calculator Calculate Cryptocurrency Tax Taxact

Coinpanda Free Bitcoin Crypto Tax Software

10 Best Crypto Tax Software In 2022 Top Selective Only

Crypto Tax Calculator Cointracking Info Rolls Out Ease Of Use Upgrades Ethereum World News

Cryptocurrency Tax 101 Intro To Capital Gains And Crypto Tax Treatment By Blockfi Blockfi Medium

Ultimate Crypto Tax Guide 2022 Koinly

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

How Is Cryptocurrency Taxed Forbes Advisor

Cryptocurrency Tax Guide 2022 How Is Crypto Taxed In The Us

Ey Launches Cryptocurrency Tax Calculator For Us Customers The Block