are hearing aids tax deductible as a business expense

Deductions can only be claimed if your total out-of-pocket. Business expense schedule C miscellaneous itemized deduction form 2106.

Did You Know Hearing Aids Are Tax Deductible

IRS Publication 502 spells out allowable.

. How To Pair Compilot With Hearing Aids Are Medical Expenses Tax Your medical expenses may be tax-deductible under certain circumstances. I believe that in the case of a director the cost of hearing aids would be an allowable expense for the company but would indeed be. A client lawyer wants to deduct hearing aids as a business expense not medical for obvious 75 reason since he bought the aids to hear the judge during evidentiary.

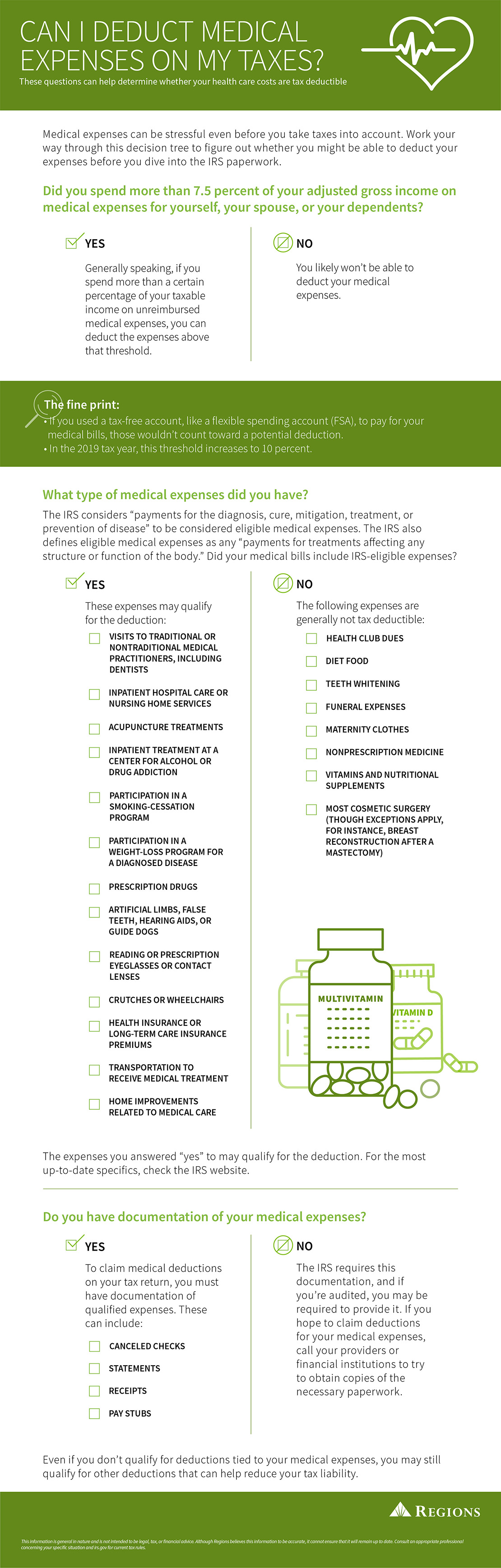

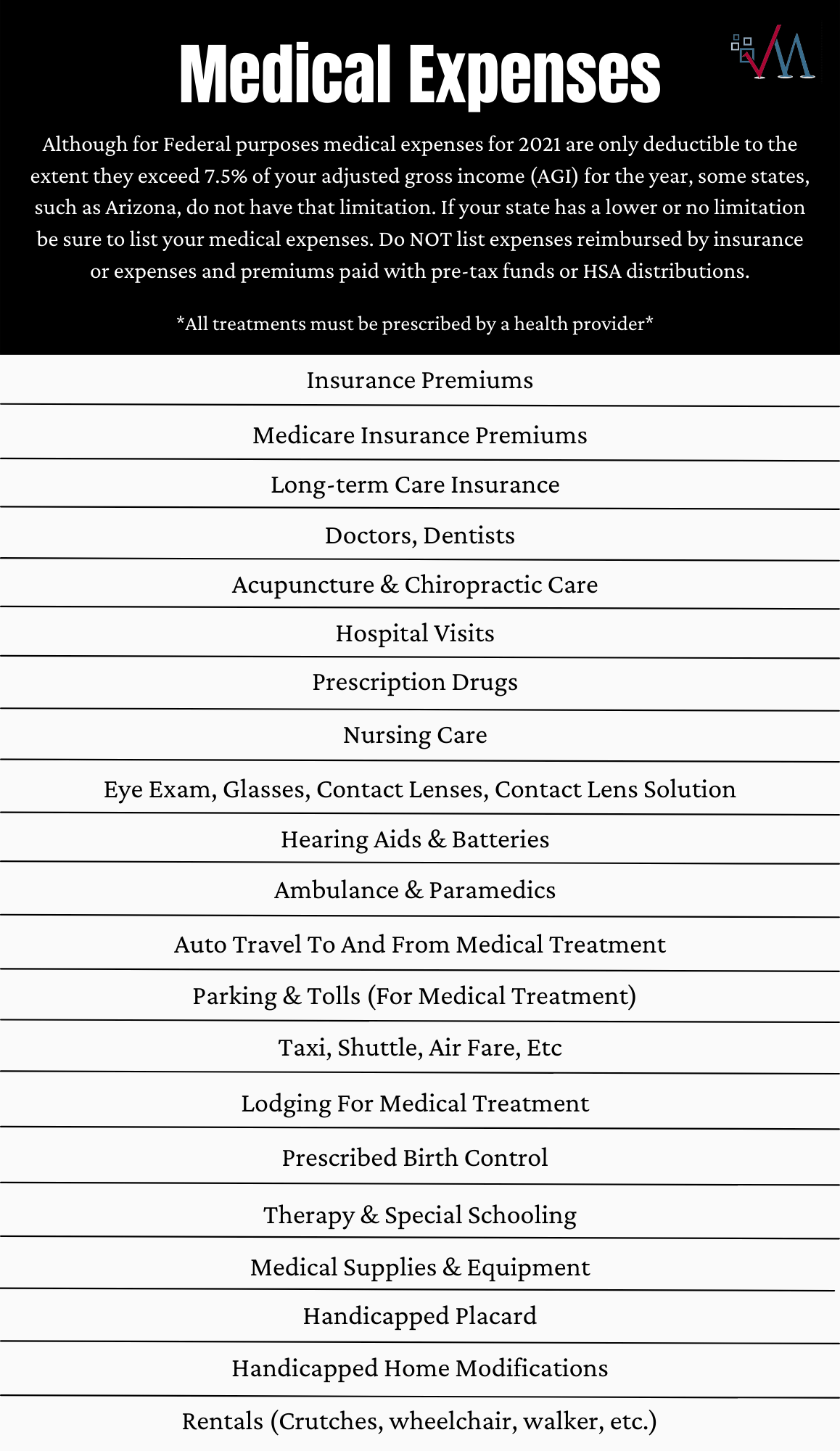

You can deduct the cost of a hearing aid as a medical expense as well as its batteries repairs and necessary maintenance for it. Many of your medical expenses are considered eligible deductions by the federal government. Income tax rebate for hearing aids.

For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return. Expenses related to hearing aids are tax. Learn more about deducting hearing devices on your taxes in this blog.

This means that if your adjusted gross income is 100000 you can only deduct 100 from your taxes for hearing aids. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. Hearing aids are most certainly a.

Since hearing loss is. According to IRS in addition to the price of hearing aid one can deduct for the doctors visit hearing test repairing of hearing aid. Taxpayers can deduct an array of medical expenses including hearing aids.

Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay. Even the hearing aid batteries are tax deductible. The short and sweet answer is yes.

Deductible medical expense on your Schedule A. The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. 09th May 2001 1306.

Hearing aids can often qualify as a tax deduction though there are still several stipulations that the 10 million americans with hearing aids will want to pay attention to. So if you need a hearing aid just for your work. While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways.

NexGen Hearing is here to help you understand whether or not hearing aids are tax-deductible in Canada. Hearing aids on average cost between about 1000 and 4000. Schedule C deductible or no.

By deducting the cost of hearing aids from their taxable income wearers could reduce. Fourth the deduction for hearing aids is only available if you itemize. This answer was rated.

Estes Audiology Hearing Centers Good News On Tax Day If You Itemize Your Medical Expenses On Your Taxes Hearing Aids Are Tax Deductible Don T Take Our Word For It Check It

Are Hearing Aids Tax Deductible What You Should Know

Are Hearing Aids Tax Deductible What You Should Know

Five Common Questions To Ask Yourself About Tax Deductible Expenses

How Much Do Hearing Aids Cost Without Insurance Mira

)

Paying For Hearing Aids Tax Breaks From Uncle Sam With Hsas And Fsas

Aarp Urges Congress To Extend And Make Permanent The Medical Expense Deduction

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Hear It Now E3 Diagnostics Blog

Can I Deduct Medical Expenses On My Taxes Regions

Tax Benefits Available To Disabled Taxpayers Deductions

Common Health Medical Tax Deductions For Seniors In 2022

9 Best Ways To Lower Your Taxes Experian

How To Pay For Hearing Aids Davenport Audiology Hearing Aid Center

Blog Tax Related Mendoza Company Inc

Are Medical Expenses Tax Deductible Credello

Are Medical Expenses Tax Deductible Chime

Donate Used Hearing Aids On Long Island Ny Mcguire S Hearing Centers